Our healthcare valuation experts have identified key areas that require the focus of U.S. healthcare executives, regulatory compliance professionals, and legal counsel in the COVID-19 era. These areas cover certain valuation principles, approaches, methodologies, and key assumptions that are crucial in establishing value estimates that continue to be reasonable and supportable for compliance purposes.

Introduction

As discussed in Part One of our series, the COVID-19 pandemic has had an unprecedented impact on the world’s economy and the healthcare industry that has increased the challenge of valuing businesses and assets. Although the fundamental principles of business valuation have not changed, this “black swan”[1] event has created additional complexities when estimating fair market value (FMV) for healthcare entities related to the premise of value, valuation date, locality considerations, and valuation approaches.

In this second installment, we will consider what the new normal might look like for healthcare providers and the impact on key assumptions in an income approach analysis. We believe this is the valuation approach best equipped to factor in specific assumptions in the COVID-19 environment.

What Will the New Normal Look Like for Healthcare Providers?

Understanding the new normal, will be a critical factor in the valuation of a healthcare entity since many of the market and business dynamics have materially changed due to the onset of COVID-19. Below are some key considerations for assessing a healthcare entity’s projected level of cash flow, timing of cash flows, and associated risks.

Varying Ability of Healthcare Facilities to Reopen

In order for the healthcare services “ecosystem” to recover, healthcare facilities must resume safe operations as soon as possible. The Centers for Disease Control and Prevention has issued guidelines for re-opening facilities to perform elective surgeries and procedures. In general, the guidelines assess the healthcare delivery systems’ ability to manage spikes in COVID-19 infection rates and hospitalization. Of critical importance is the availability of inpatient hospital and ICU beds to care for any surge in COVID–19 emergency admissions, the availability of robust testing programs, and the availability of personal protective equipment (“PPE”).

Each state will have the ultimate say as to the re-opening timing of health systems, hospitals, outpatient providers, and practices. However, if measured from the date that the national emergency was declared by President Trump (on or about March 1, 2020), the lifting of shelter in place orders could result in a significant backlog of patient visits for many healthcare providers.

Any fair market value analysis of a healthcare provider entity must consider the pandemic’s impact on the entity’s specific situation and market, and the potential barriers to recovery from a state, local, and entity-specific perspective. In addition, there is uncertainty related to the “second surge” of the virus in various locations and whether certain healthcare facilities will need to re-close after re-opening. Careful consideration will be required not only on the timing of an entity’s projected cash flow, but also the uncertainty related to the projected cash flow as reflected in the risk-adjusted discount rate.

It Won’t Be Business as Usual

A critical component to business recovery for many health systems, hospitals, and outpatient providers will be the resumption of elective procedures. However, the new normal will require significant operational changes that will likely adversely impact capacity, volume, revenue, and costs. For example:

- Facility hours may need to be expanded to accommodate pent-up demand;

- Patient and staff COVID-19 testing protocols will be required at added expense;

- Supply chain policies will need to be modified to maintain a recommended 30-day inventory for some providers;

- Scheduling policies and protocols will need to be modified to maintain social distancing leading to decreased efficiency, lower volume, and lower provider revenue;

- Higher supply cost for cleaning supplies and PPE; and

- Additional equipment may be needed to handle additional demand and extended patient turnaround time.

These operational changes will directly impact the capacity and cost structure of healthcare providers at a time when many are already financially strained. As a result, many healthcare entities will experience reduced revenue and profitability, at least for the foreseeable future.

Payer Mix Deterioration

Payer mix is an important consideration when assessing a healthcare entity’s projected revenue and cash flow. Record high unemployment and related loss of employer-sponsored health insurance may result in substantial changes in payer mix for many healthcare providers with an increase in uninsured and Medicaid patients. The chart below shows how coverage eligibility will be adversely impacted by job loss.

The anticipated shift in payer mix from commercial coverage will be partially mitigated by coverage from Affordable Care Act plans and Medicaid (especially for providers located in Medicaid expansion states). However, the higher levels of Medicaid enrollment, coupled with the increase in the number of uninsured patients, could potentially result in a reduction in revenue for a typical physician office visit by 4.3 percent, as illustrated below.

Scheduling Changes May Lead to Reduced Volume

Not only will payer mix affect provider revenues per visit, the lost patient capacity attributable to the additional time cleaning and maintaining appropriate patient spacing will likely result in a decrease in patient volume. Allowing an extra ten minutes an hour for these activities would translate into reduced patient through-put by 16.7% for a practice that operates eight hours per day. Some providers may choose to extend office hours in order to increase capacity; however, the gains will likely be partially offset by higher operating expenses.

Increased Reliance on Telemedicine for Certain Specialties

For some providers, telehealth visits have increased substantially due to restrictions on re-opening and patients who are wary of in-person visits. These virtual visits could prove beneficial to the financial health of the practice during the pandemic. There is some downside, however, as telemedicine could potentially cannibalize higher reimbursed in-person office visits.

In addition, providers are limited in the acuity level of patients that can be treated through telehealth visits. Providing telehealth services, could also require changes to staffing and appointment scheduling, as well as increase certain costs associated with implementing the infrastructure needed to support telemedicine with the practice. It will be prudent to monitor whether certain telehealth regulatory waivers will be extended or made permanent, due to the impact such waivers would have on the value of certain healthcare entities. Some states have already moved to make many of the changes permanent.

Impact of the New Normal on the Income Approach

The value of any business or asset is derived from the projected future cash flows that it can generate for the owner, the timing of those cash flows, and an adjustment reflecting the uncertainty or risk associated with those cash flows. Although estimating the value of a business or asset has always contained an element of uncertainty, periods like the current environment of a sudden and dramatic economic downturn, coupled with a sharp increase in market volatility, increase these uncertainties and risks.

It will be vital to understand how the new market dynamics are expected to impact healthcare providers in general, and the subject entity specifically. Historical revenue and expense data will likely be of limited use in estimating future performance, but can serve as a benchmark.

Enhanced due diligence will be critical to the process of building supportable projections used in the income approach. The old adage, “The past is not necessarily representative of the future,” is even more applicable in the current COVID-19 environment.

The Discounted Cash Flow (DCF) method and the Capitalized Cash Flow (CCF) method are the primary valuation methods under the Income Approach. Since the CCF method determines a value based upon a single period of earnings, the calculation of normalized earnings is critical. In these uncertain and volatile times, the amount of adjustments and normalization necessary to arrive at a single earning period that incorporates all of the current volatility would appear to make this methodology impractical in most situations. Under the DCF method, revenues, expenses, capital investment, and cash flows are projected for a discrete period, allowing the flexibility to incorporate specific risk-adjusted assumptions prior to reaching a more normalized state of financial performance for the entity.

Projecting Future Cash Flows in the Face of Unprecedented Uncertainty

In most cases, the income approach is better equipped to factor in specific expectations related to the cash flow idiosyncrasies of a business. However, even during normal economic times, it can be challenging to estimate a healthcare provider’s future cash flows. The pandemic further complicates this inherent challenge. Below are some important considerations when projecting future cash flows in a DCF analysis during the COVID-19 era.

Scenario Analysis – Considering Multiple Sets of Projections

From a fair market value perspective, projections of future cash flows should be representative of the consensus expected cash flows estimates of a hypothetical willing buyer and a willing seller. However, during periods of unprecedented uncertainty, it is possible that the hypothetical parties may have multiple cash flow forecasts under varying assumptions about uncertain future events.

It is important to consider many factors when developing projections for use in a DCF analysis. Perhaps the first consideration should be whether or not one set of projections will be adequate, or if multiple scenarios and sets of projections will be necessary to appropriately capture the range of possible scenarios related to the subject entity’s future financial performance.

Given the extreme uncertainty around dates for fully reopening healthcare provider businesses, the speed with which patient volumes will return, and the apparent “second surge” of the coronavirus in certain locations, a valuation may consider multiple sets of probability-weighted projection scenarios. The valuator will need to work extensively with management to assist with the development of projections, as management teams may be challenged by the daunting task of creating one projection in this uncertain environment, let alone multiple sets of projections.

If a scenario analysis is performed, there are several variables that could drive the difference in scenarios, such as:

- Assumed changes in payer mix due to increased unemployment levels;

- Timing and trajectory of ramp-up in patient volumes post-COVID-19; and

- Impact and timing of the apparent “second surge” in COVID-19 cases in certain locations.

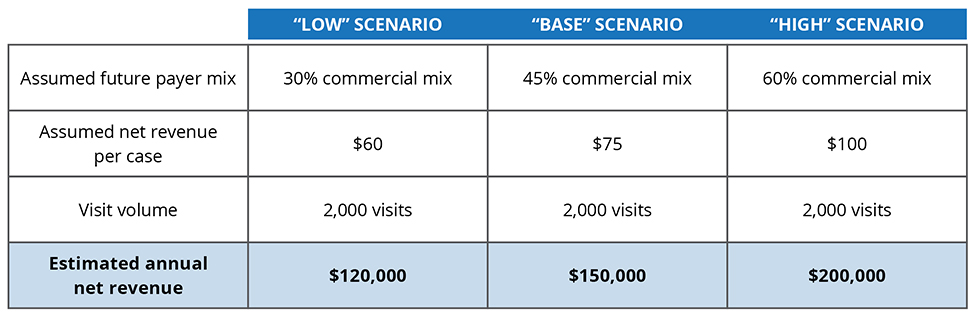

As a simple example, if one variable is potential variation in payer mix, the scenarios could be the following for a hypothetical physician practice with historical payer mix of 60% commercial and an average net revenue per case of $100:

These various annual net revenue estimates could then be used to build out the various sets of projections for use in a DCF analysis.

If multiple scenarios are considered, measures of risk must be analyzed carefully, assessing how the risk is captured in the projections. For example, one approach would be to utilize a uniform discount rate in each scenario and reflect the difference in risk factors between the scenarios in the probability weightings. Another approach would be to reflect the risk differential in the discount rates applied to each forecast and then evenly weight the scenarios. Regardless of the approach used, the risk measures should be applied consistently and not double counted.

If a scenario analysis is not practical, another potential approach would be to use one projection and perform a sensitivity analysis on factors such as revenue growth rate and discount rate to develop a range of values. In general, we believe in most cases it would be prudent to place more focus on potential cash flow adjustments, rather than simply relying on discount rate adjustments.

Examination and Re-Examination of All Elements of the Projections

Regardless of how many sets of projections are considered, a deep dive into the projections and a re-examination of each input impacting the cash flow is necessary. For many healthcare providers, the impacts of the pandemic may require changing certain aspects of their operations. Revenues will certainly be impacted, at least in the short-term, whether it be through decreased patient volume or shifting payer mix, potentially causing declines in reimbursement, or a combination of the two. Expenses are also likely to be impacted by the new environment and these must be reflected in the projections.

Finally, one of the major challenges for most businesses during the pandemic has been maintaining liquidity and access to working capital in order to keep the doors open while revenues are drastically reduced. Decreases in healthcare provider revenues can directly impact maintenance and growth capital expenditures, which must be considered in a cash flow analysis.

According to a new survey from HFMA and Guidehouse Health, 89% of hospital and health system executives predict their organizations’ revenues will be lower at the end of 2020, compared to pre-COVID-19 levels. Among respondents, almost two-thirds project decreases of greater than 15%, while one-fifth forecast decreases of more than 30%.

To offset COVID-19’s financial impact, executives cited reductions in capital expenditures including new and existing construction (76% of respondents), labor adjustments such as furloughs, layoffs, and hiring freezes (76% of respondents), and canceling or renegotiating contracts and co-management agreements (69% of respondents) as areas they’ll most likely target for intermediate and long-term cost reductions.”[2]

Potential questions specific to the subject entity include:

Revenue Considerations:

- What are the local orders regarding COVID-19-related shutdowns and what is the expected timeline for re-starting services?

- What is the typical patient profile in the local market and how does this relate to COVID-19 impacts and behaviors going forward for this population? (i.e. Is the patient population of the subject entity at high risk for COVID-19 and thus likely to self-quarantine for the foreseeable future?)

- Is the payer mix of the patient population expected to shift?

- How will this shift impact reimbursement?

- How will increased unemployment in the market impact the patient population and demand for services?

- Is there pent-up demand for services? If so, when is this expected to normalize?

- Will scheduling concerns related to social distancing reduce scheduling efficiency, thereby impacting volume?

- How would potential PPE shortages impact the ability to see patients?

- Which government assistance programs did the subject entity utilize (g., Paycheck Protection Program (PPP), Emergency Economic Injury Grants (EEIG), Economic Injury Disaster Loans (EIDL), and the Small Business Debt Relief Program (SBDRP)) and what were the amounts and timing of these payments?

Expense Considerations:

- Has the fixed and variable cost structure changed?

- Will supply chain issues impact cost?

- Will staffing and/or supply costs increase due to increased infection control protocols and the need for increased levels of PPE?

- Will staffing costs change materially due to potential changes in scheduling patterns that may be necessary to address social distancing concerns?

- Will physician compensation change?

- How will any changes in operations impact the administrative burden and associated costs?

- How will increased focus on safety impact operations and costs?

Working Capital and Capital Expenditure Considerations

- What is the entity’s current working capital position? Is there financing available to help the entity recover?

- What is the entity’s exposure to bad debt write-offs for underfunded health spending accounts associated with high deductible health plans?

- Did the entity defer any payments during the pandemic that will need to be paid in the future? What is the timing of these payments? Are there any payment penalties?

- How do any payments received through COVID-19 government programs impact working capital or capital expenditures?

- How are typical working capital needs for the industry expected to change in the post-pandemic environment?

Consider the Impact of Government Loans and Grants

Many healthcare providers are small businesses. In response to the financial hardships caused by the pandemic, the U.S. government provided financial assistance to many small businesses thorough the CARES Act.[3] Many healthcare provider entities received financial assistance from the government in the form of loans and grants that may be forgiven.

Recently, the Treasury Department and Small Business Administration released information about PPP loans above $150,000. The healthcare sector received more than 12% of the total loans disclosed, with the biggest recipients being physician practices that received at least $8.4 billion in PPP loans.[4]

It will be important to understand the type and amount of assistance received by the subject entity in order to model the impacts of this into the cash flow analysis. The factors to consider include:

- Probability that the subject entity will have to repay all, or part, of the amounts received and the timing of any repayments;

- Tax implications of the assistance received;[5] and

- Normalizing adjustments that may be needed to the projections to reflect the receipt of these funds.

There are publicly available resources that provide details about the various government programs which may be helpful as a reference. One such resource is the AICPA’s Coronavirus (COVID-19) Resource Center.[6]

Multi-Stage Forecasting May be Necessary

Economic recovery will be phased across the U.S. and will differ across healthcare providers depending on their specialty and the dynamics of their local market. As long as the post-COVID-19 environment and the timing and pace of the economic recovery remains extremely unclear, a multi-stage cash flow forecast in the DCF analysis may not be unreasonable.

A multi-stage forecast would involve the application of differing discount rates that reflect different risk characteristics of the various periods of the DCF. For example, a higher discount rate may be applied in the initial periods of the cash flow forecast, while lower discount rates (reflecting decreasing levels of risk) may be applied in the later periods, which would presumably present less uncertainty as the environment stabilizes.

Estimating Discount Rates – More Complicated than Ever

Like so many other elements of a DCF analysis, the task of developing discount rates has become increasingly complex in this environment. Multiple discount rates may be necessary if a multi-stage forecasting model is selected with support for the differential between the rates selected for each period.

It is also important to closely examine all of the elements of the discount rate relative to the pandemic. For example, the equity risk premium should presumably reflect additional market risk, but the valuator must carefully consider the valuation date and the source of the equity risk premium to assess if the increased market volatility is embedded in the premium.

The company-specific risk premium is a subjective assumption that traditionally receives a high level of scrutiny due to its subjectivity. This will continue as company-specific risk premiums will likely increase in the post-pandemic environment given the high level of uncertainty many healthcare providers are facing. However, one must be cautious not to overstate various risk elements in the discount rate if some of the uncertainty is already reflected in the cash flow. This will involve consideration of the valuation date, the industry risk premium data available as of that date, and whether or not the equity risk premium data already reflects the COVID-19 environment.

The cost of debt must also be re-examined, as the cost of financing for many entities may have increased as lenders have tightened credit requirements due to the pandemic’s economic impacts. In addition, when evaluating an entity’s balance sheet, it is important to distinguish between pre-COVID-19 debt and any forgivable loans that the entity may have obtained as part of the government’s pandemic relief efforts.

Documentation is Critical

The complexity of developing a DCF valuation analysis has only increased with the pandemic’s impact on the healthcare provider industry. The outlook for the economic recovery and COVID-19’s trajectory appears to be constantly evolving and much uncertainty remains. In this dynamic environment, it is more important than ever to thoroughly document the key assumptions of a valuation analysis.

According to valuation standards and general practice, the valuation should only consider facts that were “known or knowable” as of the valuation date. In such a rapidly changing environment, thorough documentation of what was “known or knowable” at a given point in time is critical. As of the writing of this piece, the economic outlook for the U.S. is changing rapidly from week to week as pandemic-related impacts on the economy continue to evolve.

Thus, “known or knowable” information changes from week to week and it is critical that current information is considered and documented since economic outlooks evolve quickly. Clear documentation of the information, outlook and expectations available, as of the valuation date, will be invaluable in creating supportable valuations that could withstand later scrutiny, should it arise.

Key Takeaways

Estimating the value of healthcare provider businesses has become more complex in the COVID-19 era. Although the income approach is generally better equipped to incorporate specific cash flow, timing, and risk assumptions, the merits of the approach must be coupled with enhanced due diligence and documentation of key valuation model assumptions in order to ensure that the results truly capture reality facing healthcare providers – a new normal that is far from certain.

[1] Taleb, Nassim Nicholas (2010) [2007]. The Black Swan: The Impact of the Highly Improbable (2nd ed.). London: Penguin. In this book, Mr. Taleb summarizes the characteristics of a “Black Swan” event as “First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries an extreme ‘impact.’ Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.”

[2] “Hospitals Forecast Declining Revenues & Elective Procedure Volumes, Telehealth Adoption Struggles from COVID-19,” Guidehouse article by David Burik, May 21, 2020.

[3] Coronavirus Aid, Relief and Economic Security Act, passed in 2020.

[4] “Physicians’ offices big beneficiaries of small-business COVID-19 relief loans,” Modern Healthcare, July 7, 2020.

[5] The IRS recently clarified that for-profit healthcare providers will have to pay taxes on the grants they received from the COVID-19 Provider Relief Fund.

[6] This resource is found at https://future.aicpa.org/resources/toolkit/aicpa-coronavirus-resource-center and includes information such as “Valuation Considerations Related to the CARES Act,” https://www.aicpa.org/interestareas/forensicandvaluation/resources/businessvaluation/valuation-considerations-related-to-cares-act.html#:~:text=The%20key%20provisions%20impacting%20business,Debt%20Relief%20Program%20(SBDRP).

© Copyright 2020. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.